non filing of tax return meaning

Fine of not less than P10000 and imprisonment of not less than one 1 year but not more than 10 years. As of the date of this letter we have no record of a processed tax return for the tax period listed above.

What To Do If You Receive A Missing Tax Return Notice From The Irs

If the amount of tax unpaid.

. The type of tax return filed by an individual. In general a person who has filed taxes once must continue to do so for the rest of hisher life or existence if a corporation. You can consider this letter a verification of non-filing The Tax Periord or Periods is December 2018.

This non tax filing statement is required if the student andor their spouse will not file and are not required to file a 2018 income tax return with the IRS. The non-filing and the non-payment of tax returns are two of the most common violations committed by the taxpaying public. Non-filing of Income Tax Return by itself would not mean that the complainant had no source of income and thus no adverse inference can be drawn in this regard only because of absence of Income Tax Return.

Updated 10152021 0838 AM. Today my transcripts updated to show the following under Return Transcript for 2020. Based on 4 documents.

Therefore if the taxpayer does not file a return or the examiner does not prepare a return from information provided by the taxpayer on the return forms prescribed for filing which the taxpayer signs the taxpayer is unable to elect joint return filing status. Each ITR penalty mentioned in the above table is subject to several conditions. We have no record of a filed Form 1040 1040A or 1040EZ using the above Social Security Number.

You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year if you have US. On June 18 2021 we received a request for verification of non-filing of a tax return. The Tax Code considers failure to file ITR and failure to pay income tax as crimes of the same nature and gravity because these two crimes are found in the same Section 255 of the Tax Code and they carry exactly the same penalties.

Work with Jackson Hewitt to Find Solutions for Resolving Your Notice From the IRS. 2012 Farlex Inc. Income on which the tax liability was not satisfied by the withholding of tax at the source or if you want to claim a refund of access withholding or want to claim the benefit of any deductions of credits.

However the benefits lost on non-filing of returns are more than the penal provisions imposed for non-filing. Both single and married taxpayers with and without dependents file this type of return. Non-Filer means any Party that is not responsible for filing the applicable Tax Return pursuant to Sections 41.

If requested on your FAST page please obtain a Verification of Non-Filing letter from the IRS and submit a copy to the Financial Aid Office. If you have any questions you can call 800-829-1040. 50 of the total tax payable on the income for which no return was furnished.

A person with taxable income fails to file his ITR or is found to under-report his income in the returns. Sample 1 Sample 2 Sample 3. Where the accused has failed to satisfactorily explain the circumstances under which the cheque was issued by the accused or misused by.

You or your parents may be required to provide verification that you did not file a federal tax return as part of the federal verification process. We work with you and the IRS to settle issues. Individual Tax Return.

Individual filers always file their. Non-filing of Income Tax Return attracts interest penalty prosecution and scrutiny from the Income Tax Department. Following are the benefits of filing of the income tax returns.

Whether the non-compliance is a mere omission or a deliberate attempt to. Non-Filer means an individual who is not expected to file a tax return or be claimed as a tax-. Non-filing of Income Tax Return by itself would not mean that the complainant had no source of income and thus no adverse inference can be drawn in this regard only because.

But does not exceed. Non-filing of Income Tax Return by itself would not mean that the complainant had no source of income and thus no adverse inference can be drawn in this regard only because of absence of Income. A non-filer may be subject to interest late fees and other penalties.

Income Taxes for a Combined Group or any other affiliated consolidated combined unitary fiscal unity or other group basis including as permitted by. Failure to file andor pay any internal revenue tax at the time or times required by law or regulation. It says We received a request dated March 30 2020 for verification of non-filing of returns for the above tax period or periods.

A student or parent who has never filed a federal tax. Non-Income Tax Return means any Tax Return relating to any Tax other than an Income Tax. A person or corporation who does not file a tax return by the required date.

An IRS Verification of Non-filing Letter is proof authenticated by the IRS that the applicant or the person whose name is in the IRS letter did not file an income tax return in Form 1040 1040A or 1040EZ for the year written therein. Ad The IRS contacting you can be stressful.

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

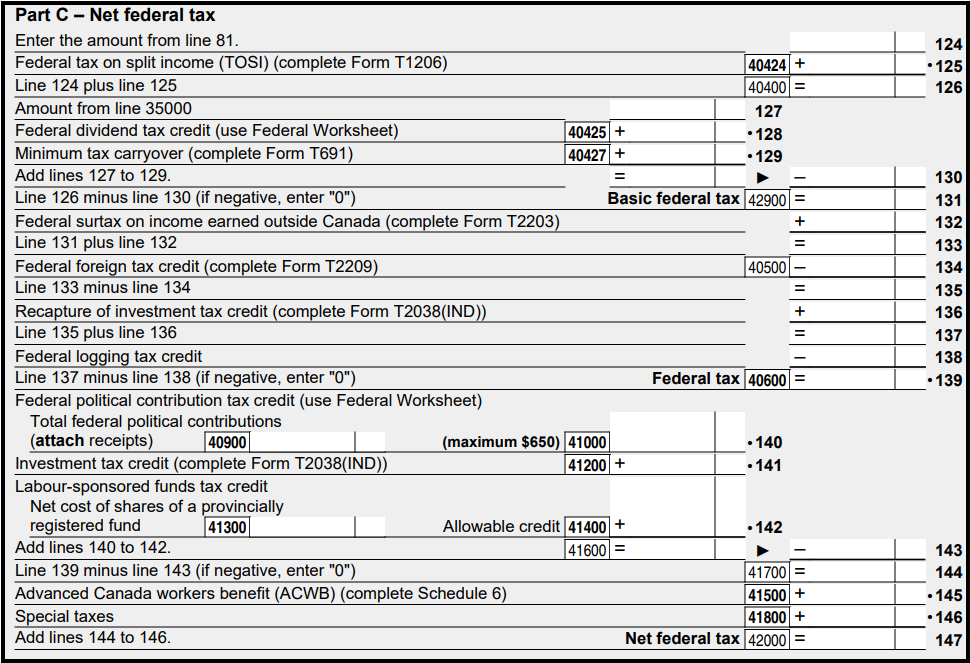

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Taxpayers Demand For Extension Of Deadline For Filing Of Income Tax Returns As Date Nears In 2022 Filing Taxes Tax Return Income Tax Return

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Do You Know About Annual What Is Annual Return Gstr 9 Know About The Due Date Eligibility Filing Format And The Penalty Levied Due Date Meant To Be Dating

:max_bytes(150000):strip_icc()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

The Ultimate Guide To Doing Your Taxes

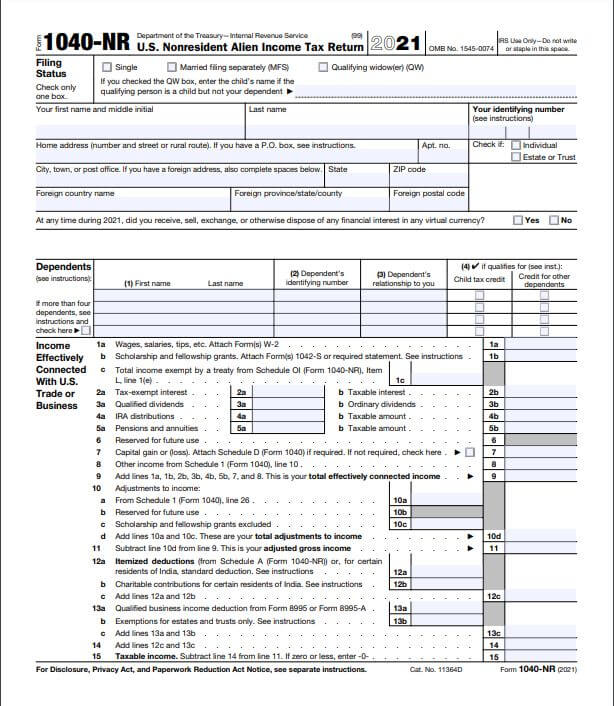

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Common Usa Tax Forms Explained How To Enter Them On Your Canadian Tax Return 2022 Turbotax Canada Tips

How To Register On The Income Tax Website And File Returns Income Tax Income Tax Return Filing Taxes

How To Fill Out A Fafsa Without A Tax Return H R Block

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)